Definition: Securitization is the method of converting the receivables of the financial institutions, i.e., loans and advances, into bonds which are then sold to the investors. In simple terms, it is the means of turning the illiquid assets into liquid assets to free up the blocked capital.

The receivables on debts against collateral assets like property, land, building and other real estate, become exchangeable financial instruments in this process of securitization.

Content: Securitization

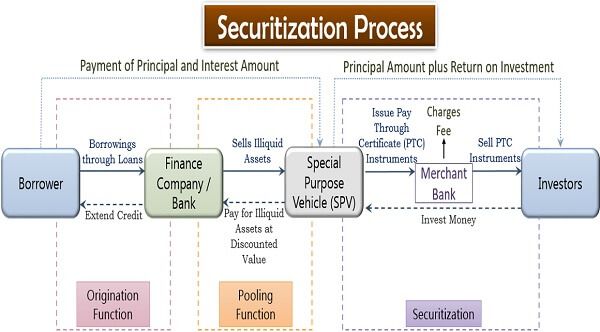

Securitization Process

Securitization is a complex and lengthy process since it is the conversion of the receivables into bonds; it involves multiple parties.

The steps involved in the process of securitization are as follows:

Origination Function: The borrower approaches a bank or other financial institution (originator) for a loan. The respective financial institution allows a certain sum as debts in exchange for any collateral.

Pooling Function: The originator then sells off its receivables through pledge receipts to the special purpose vehicle.

Securitization: The SPV transforms these receivables into marketable securities, i.e., either Pay Through Certificate or PTC (Pass-Through Certificate). These instruments are then forwarded to the merchant banks for selling it to the investors. The investors buy these instruments to benefit in the long run.

Since the investors extend the loan, they are liable to receive a return on investment. The borrowers are unaware of this securitization and pay timely instalments.

The originator receives a lump sum amount, though at a discounted value from the SPV. The merchant bank charges fees for its services.

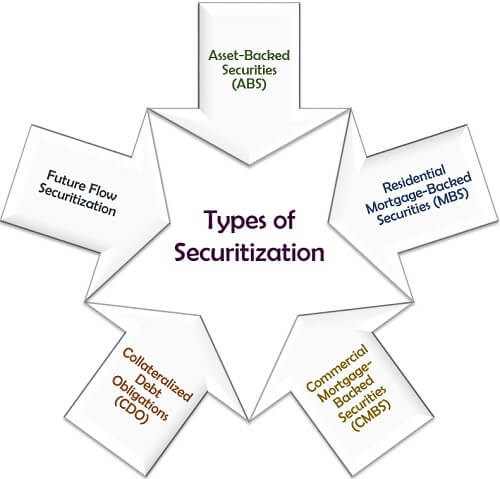

Types of Securitization

The different kinds of receivables determine the type of securitization it requires. Given below are some of the most common types of securitization:

Asset-Backed Securities (ABS)

The bonds which are supported by underlying financial assets. The receivables which are converted into ABS include credit card debts, student loans, home-equity loans, auto loans, etc.

Residential Mortgage-Backed Securities (MBS)

These bonds comprise of various mortgages like of property, land, house, jewellery and other valuables.

Commercial Mortgage-Backed Securities (CMBS)

The bonds that are formed by bundling different commercial assets mortgage such as office building, industrial land, plant, factory, etc.

Collateralized Debt Obligations (CDO)

The CDOs are the bonds designed by re-bundling the personal debts, to be marketed in the secondary market for prospective investors.

Future Flow Securitization

The company issues these instruments over its debts receivable in a future period. The company meets the principal and interest through its routine business operations, though such obligations are secured against its future receivables.

Advantages of Securitization

In the securitization process, the multiple parties involved are borrowers, originator, special purpose vehicle, merchant bank and investors.

Thus, each one these parties benefit from the process, where the originator and the investor have multiple advantages as discussed below:

To the Originator

The originator derives maximum benefit from securitization since the purpose is to get the blocked funds released to take up other alluring opportunities. Let us discuss each one of these:

Unblocks Capital: Through securitization, the originator can recover the amount lent, much earlier than the prescribed period.

Provides Liquidity: The illiquid assets, such as the receivables on loans sanctioned by the bank, are converted into liquid assets.

Lowers Funding Cost: With the help of securitization, even the BB grade companies can benefit by availing AAA rates if it has an AAA-rated cash flow.

Risk Management: The financial institution lending the funds can transfer the risk of bad debts by securitizing its receivables.

Overcoming Profit Uncertainty: When the recovery of debts is uncertain, its profitability, in the long run, is equally doubtful. Thus, securitization of such obligations is a suitable option to avoid loss.

Reduces Need for Financial Leverage: Securitization releases the blocked capital to maintain liquidity; therefore, the originator need not seek to financial leverage in case of any immediate requirement.

To the Investor

The investor’s aim is to accelerate the return on investment. Following are the different ways in which securitization is worth investing:

Quality Investment: The purchase of MBS and ABS are considered to be a wise investment option due to their feasibility and reliability.

Less Credit Risk: The securitized assets have higher creditworthiness since these are treated separately from their parent entity.

Better Returns: Securitization is a means of making a superior return on their investment; however, it depends more on the investor’s risk-taking ability.

Diversified Portfolio: The investor can attain a well-diversified portfolio on including the securitized bonds; since these are very different from other instruments.

Benefit Small Investors: The investors having minimal capital for investment can also make a profit out of securitized bonds.

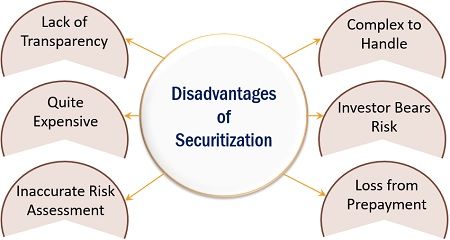

Disadvantages of Securitization

Securitization requires proper analysis and expertise; otherwise, it may prove to be quite unsound to the investors. Let us now discuss its various drawbacks:

- Lack of Transparency: The SPV may not disclose the complete information about the assets included in a securitized bond to the investors.

- Complex to Handle: The whole process of securitization is quite complicated involving multiple parties; also, the assets need to be blended wisely.

- Quite Expensive: When compared to share flotation, the cost of a securitized bond is usually high, including underwriting, legal, administration and rating charges.

- Investor Bears Risk: The non-repayment of debts by the borrower would ultimately end up as a loss to the investors. Therefore, the investor is the sole risk-bearer in the process.

- Inaccurate Risk Assessment: Sometimes, even the originator fails to identify the value of underlying assets or the associated credit risk.

- Loss from Prepayment: If the borrower pays off the sum earlier than the defined period, the investors will not make superior gains on their investment value.

Conclusion

Securitization is not considered to be an excellent investment opportunity by many investors since the risk involved in it is quite high even after being backed by collateral security.

However, if the creditworthiness of the borrower and the prevailing investment opportunity is analyzed proficiently; it may generate high returns for the investors.

annamalai k says

excellent simple explanation , easily understandable